Recent Research in the Media

- Reducing Spending And Enhancing Value In US Health Care: Reflections On The GAO Report

Federal health spending plays a central role in the nation’s long-term fiscal outlook. Medicare, Medicaid, the Children’s Health Insurance Program, and private health insurance spending are projected to increase in the coming years. These unsustainable trends—occurring without commensurate improvements in population health— create a burning need for reform: Without meaningful change, rising health care costs will increasingly strain household budgets, crowd out other federal and state priorities, and undermine the nation’s long-term fiscal stability.

Against this urgent backdrop, the United States Government Accountability Office issued its 2024 report, “Highlights of a Forum: Reducing Spending and Enhancing Value in the U.S. Health Care System”. The report summarizes the discussions of an expert forum convened in October 2024. Dr. Papanicolas and Dr. Scheffler, the director of the Petris Center, highlight below the areas the group believes are most critical for policymakers to consider and offer new insights that have gained salience given shifts in the policy landscape since the forum was conducted.

Please view the report linked here.

- Texans Warned of Health Insurance Premium Rise in 2026

In a Newsweek article, Jasmine Laws, discusses how health insurance premiums are expected to increase across the country, with the possibility of certain states experiences much higher increases. While the enhanced tax credits were originally implemented by former President Joe Biden for those using ACA marketplaces are set to expire at the end of 2025 are impacting the increase in premium costs, there are also a number of other factors affecting these costs including inflation, labor costs, and high-priced drugs. Richard Scheffler, tells Newsweek, that “rises in premium costs are routine.”

Read the full article here.

- The United States Government Accountability Office Discusses Reducing Spending and Enhancing Value in the U.S. Health Care System

The US Government Accountability Office (GAO) convened a diverse panel of 30 health care experts to focus on the challenges of health care spending. Richard Scheffler was a member of the panel and was involved in conversations to help identify issues associated with increased health care spending in the United States. The panel was comprised of federal government officials, academics, researchers, clinicians, and industry experts who represented a range of expertise and experiences.

To read the full highlights from the forum, please view this link. - UnitedHealthcare Is Struggling To Recover From Luigi Mangione

In an Newsweek article, Jasimine Laws, discusses how the alleged shooter, Luigi Mangione, became secondary to the public’s outrage at UnitedHealthcare itself, with social media mocking the company over high healthcare costs and denied care. The backlash has led to stock losses and legal threats. Richard Scheffler told Newsweek, “The oversize profits at a time where health care is becoming even more unaffordable is a key factor in the negative view of company.”

Read the full article here. - Invited Commentary: Unanswered Questions on Private Equity in Gastroenterology

Jane M. Zhu, MD, MPP, Division of General Internal Medicine, Oregon Health & Science University, comments on this issue of JAMA Health Forum, Arnold et al. Zhu discusses that the inclusion of a number of quality metrics in the analysis is significant to the conversation.

To view Zhu’s full commentary, please see the PDF below.

Recent Publications

- UnitedHealthcare Pays Optum Providers More Than Non-Optum Providers

By Daniel R. Arnold and Brent D. Fulton | Published November 3, 2025, in Health Affairs | Link to Full Article

During the past several decades, physicians have transitioned from small, physician-owned practices to larger practices owned by corporations such as hospitals, private equity firms, and health insurers. UnitedHealth Group, the largest US health care company by revenue, sells insurance products under the UnitedHealthcare brand while providing health care services under the Optum brand, which has more than 90,000 aligned physicians. Although there are benefits to insurer-physician integration, potential concerns include regulatory gaming of the medical loss ratio and partial foreclosure of rival physician practices. This descriptive study used Centers for Medicare and Medicaid Services payer transparency data for the employer-sponsored and individual markets to show that when the relative price paid to Optum versus non-Optum providers is analyzed, UnitedHealthcare’s payments are 17 percent higher than the relative price of its competitors. In markets where UnitedHealthcare has 25 percent or more market share, this percentage increases to 61 percent. The results suggest that intercompany transactions within health care conglomerates may warrant scrutiny, as they may be signals of regulatory gaming or attempted foreclosure.

- Reducing Spending And Enhancing Value In US Health Care: Reflections On The GAO Report

Federal health spending plays a central role in the nation’s long-term fiscal outlook. Medicare, Medicaid, the Children’s Health Insurance Program, and private health insurance spending are projected to increase in the coming years. These unsustainable trends—occurring without commensurate improvements in population health— create a burning need for reform: Without meaningful change, rising health care costs will increasingly strain household budgets, crowd out other federal and state priorities, and undermine the nation’s long-term fiscal stability.

Against this urgent backdrop, the United States Government Accountability Office issued its 2024 report, “Highlights of a Forum: Reducing Spending and Enhancing Value in the U.S. Health Care System”. The report summarizes the discussions of an expert forum convened in October 2024. Dr. Papanicolas and Dr. Scheffler, the director of the Petris Center, highlight below the areas the group believes are most critical for policymakers to consider and offer new insights that have gained salience given shifts in the policy landscape since the forum was conducted.

Please view the report linked here.

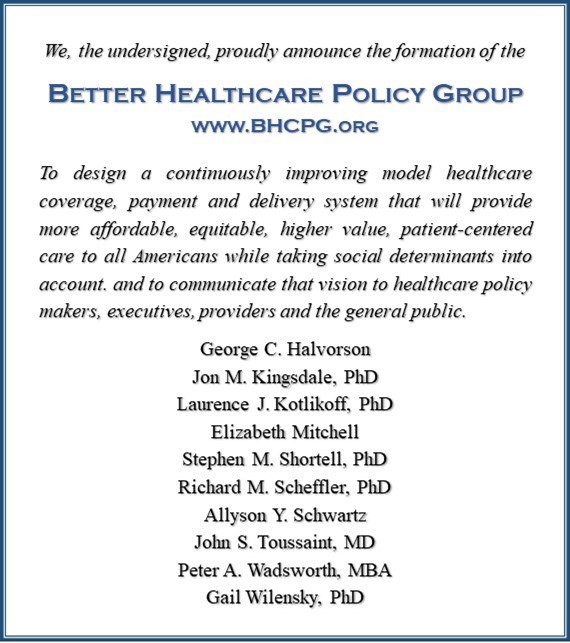

Petris Director Joins the Better Healthcare Policy Group